Shopify Accounting and Bookkeeping Services

A Complex Ecosystem with No Guide

Shopify boasts over 8,000 apps for eCommerce businesses to make use of, which equals almost unlimited data sources. While the additional control that an eCommerce business has in selling on Shopify vs a marketplace like Amazon is nice, it’s more challenging to do accurate bookkeeping and manage tax compliance while operating a Shopify store.

What is Shopify Accounting

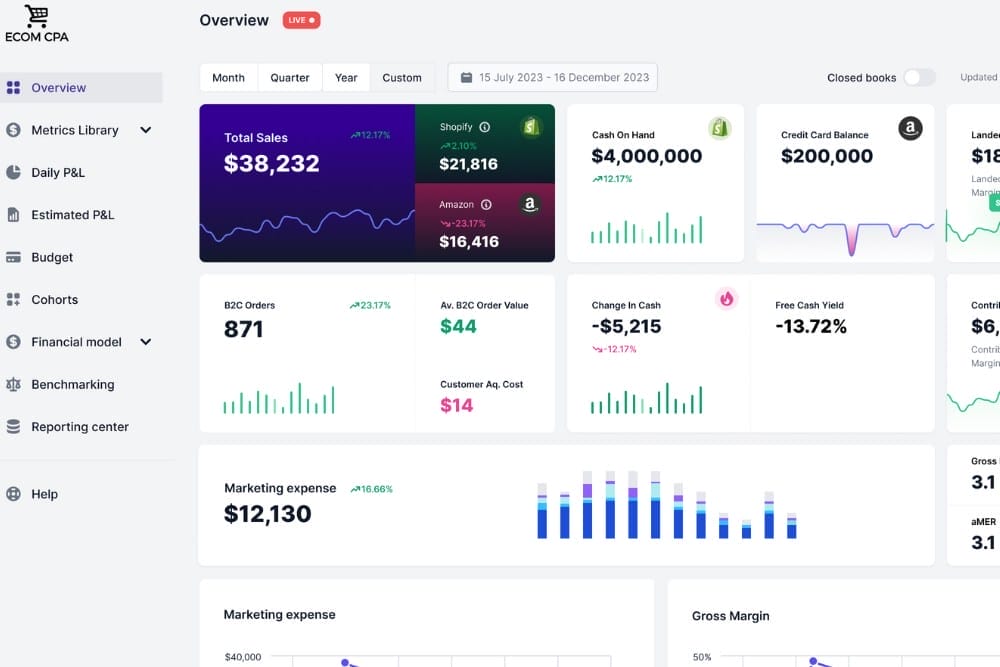

It’s keeping a real time pulse on the financial health of your Shopify business. eCommerce accounting as a whole is relatively new. You don’t measure your success on Shopify on a monthly cadence, yet most CPA firms are zoomed in and solely focussed on the monthly close vs taking a step back to understand your supply chain, COGs, your inventory turns, your marketing channels, and how you track inventory. We zoom out and have the ability to zoom in too!

Shopify Sellers Need Specialists Not Generalists

It’s easy for an eCommerce company operating a Shopify Store to end up with financial statements that give an incomplete or inaccurate picture. There are a few reasons why this happens so often:

COGs and Inventory Process

Fluctuating supplier and shipping costs, inventory tracking, returns and discounts…pulling that all together in a meaningful way is challenging. We help eCommerce businesses build new processes or can help improve current ones.

Technology Gap

Lack of Expertise

Standard accountants often lack the specialized knowledge required to make sense of Shopify specific data, how selling on Shopify actually works. From setting up a correct chart of accounts to understanding Shopify specific expenses a Shopify seller incurs selling on the platform, it takes years of experience to master Shopify accounting.

Settling for Less

Most Shopify sellers have never experienced proper eCommerce accounting in action, and the bar is set pretty low. Wondering if your current accounting is being done correctly? We offer a no cost evaluation of your current accountants work and will walk you through the results.

Our Process is Different

eCommerce business owners want a Shopify accounting firm that gets up to speed fast and delivers financial reports consistently on time.

Speedy Onboarding

Our aim is to get you up and running within just six days. The onboarding phase includes a ‘Client Health Check’—our proprietary method to identify the areas that need immediate focus.

Expectation Setting

Before anyone comes on board to do accounting with ECOM CPA we identify how you’re going to grade us, and have created an expectations document we both have to sign off on to make sure the relationship works.

The First 3 Months

To lay a foundation that supports scalable growth, we spend the first quarter understanding your payment processors, banking, debt, supply chain, technology, vendors, and manufacturing processes (if applicable), with a particular focus on nailing down inventory and COGs.

Customization

Need us in the books more frequently during peak season…a weekly cash flow statement? Want more meetings initially or when launching new products/sales channels? We offer a tailored approach to meet your specific needs.

Pricing

We offer accounting plans built for the stage of growth you are in, starting at $1250/month. Our Basic Accounting with eCommerce bookkeeping is far more advanced than some firms’ Premium Offering and includes:

- Inventory/COGs Reconciliation

- Monthly One on One Review

- Sales Channel Profitability

- KPI Target monitoring

- All the accounting tasks you don’t want to do

We’re Not a Perfect Fit For Everyone

Here are a few reason why ECOM CPA may not be the right firm for you:

- You’re not a private label brand. Arbitrage and wholesale don’t typically require specialists.

- No SINGLE internal point person or sense of urgency. We don’t want to interrupt you while you are doing your most meaningful work, but there will be things someone needs to clarify. Is there a qualified individual that can provide us what we need in a timely manner? If not…we aren’t a match.

- Early stage - almost all our clients are 7-9 figure brands that are growing intentionally.

Download our free eCommerce Accounting Comparison Guide

When looking for the right accounting partner, it’s critical to compare potential solutions side by side. We’ve identified the most important factors to consider before choosing an accounting firm, based on asking every interested party we meet with “how are you going to grade us when it comes to your expectations,” and then layering in all we’ve learned about eCommerce from the beginning of ECOM CPA till now.

eCommerce Accounting Varies Based on the Platform you Sell on

Ready To Chat?

Get in touch and learn exactly how we can help simplify your finances.