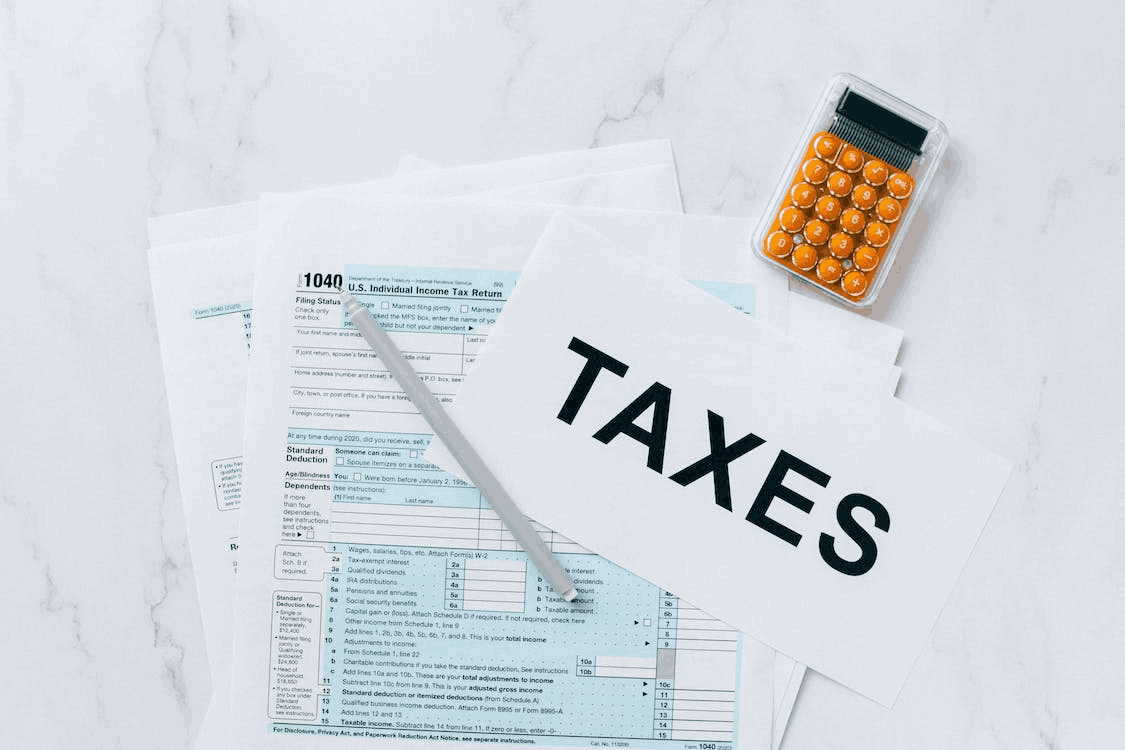

Demystifying US Tax Obligations for Foreign eCommerce Sellers

Navigating the complexities of US tax laws can be daunting for foreign eCommerce sellers. With businesses crossing borders more easily thanks to the internet, understanding

We write about things our clients tell us are important. Have specific requests for a Blog, shoot it over to [email protected].

Navigating the complexities of US tax laws can be daunting for foreign eCommerce sellers. With businesses crossing borders more easily thanks to the internet, understanding

A whopping 82% of businesses fail due to poor cash flow management. This is how crucial smart cash flow strategies are in business success, especially

In the dynamic landscape of eCommerce, scaling your business often comes with a multitude of financial challenges. As your revenue surpasses the million-dollar mark, strategic

Accrual accounting is one of the foundational concepts in the field of accounting, playing a crucial role in how businesses record and manage their transactions.

Being a business owner entails managing all facets of your enterprise, including its financial aspects. The assistance of professional bookkeepers and accountants can prove invaluable

An S corporation is a pass-through entity for tax purposes. This implies that the income losses and credits aren’t made at the corporate level. Instead,

There are two distinct models in the ever-evolving commerce space. e-commerce, driven by the digital revolution, has reshaped the way we buy and sell. Meanwhile,

Navigating the financial landscape of a business involves managing a variety of transactions, current liabilities, and financial performances. These activities need to be meticulously recorded

Cash accounting and accrual accounting are two primary methods used in accounting to record financial transactions. However, they differ in how they recognize revenue and

Looking for some extra cash in your business? One of our clients was thrilled to receive additional unexpected money from the IRS this month, when

Get in touch and learn exactly how we can help simplify your finances.