Unpacking the Differences between E-commerce and Brick-and-Mortar Retail Accounting

There are two distinct models in the ever-evolving commerce space. e-commerce, driven by the digital revolution, has reshaped the way we buy and sell. Meanwhile,

We write about things our clients tell us are important. Have specific requests for a Blog, shoot it over to [email protected].

There are two distinct models in the ever-evolving commerce space. e-commerce, driven by the digital revolution, has reshaped the way we buy and sell. Meanwhile,

Navigating the financial landscape of a business involves managing a variety of transactions, current liabilities, and financial performances. These activities need to be meticulously recorded

Cash accounting and accrual accounting are two primary methods used in accounting to record financial transactions. However, they differ in how they recognize revenue and

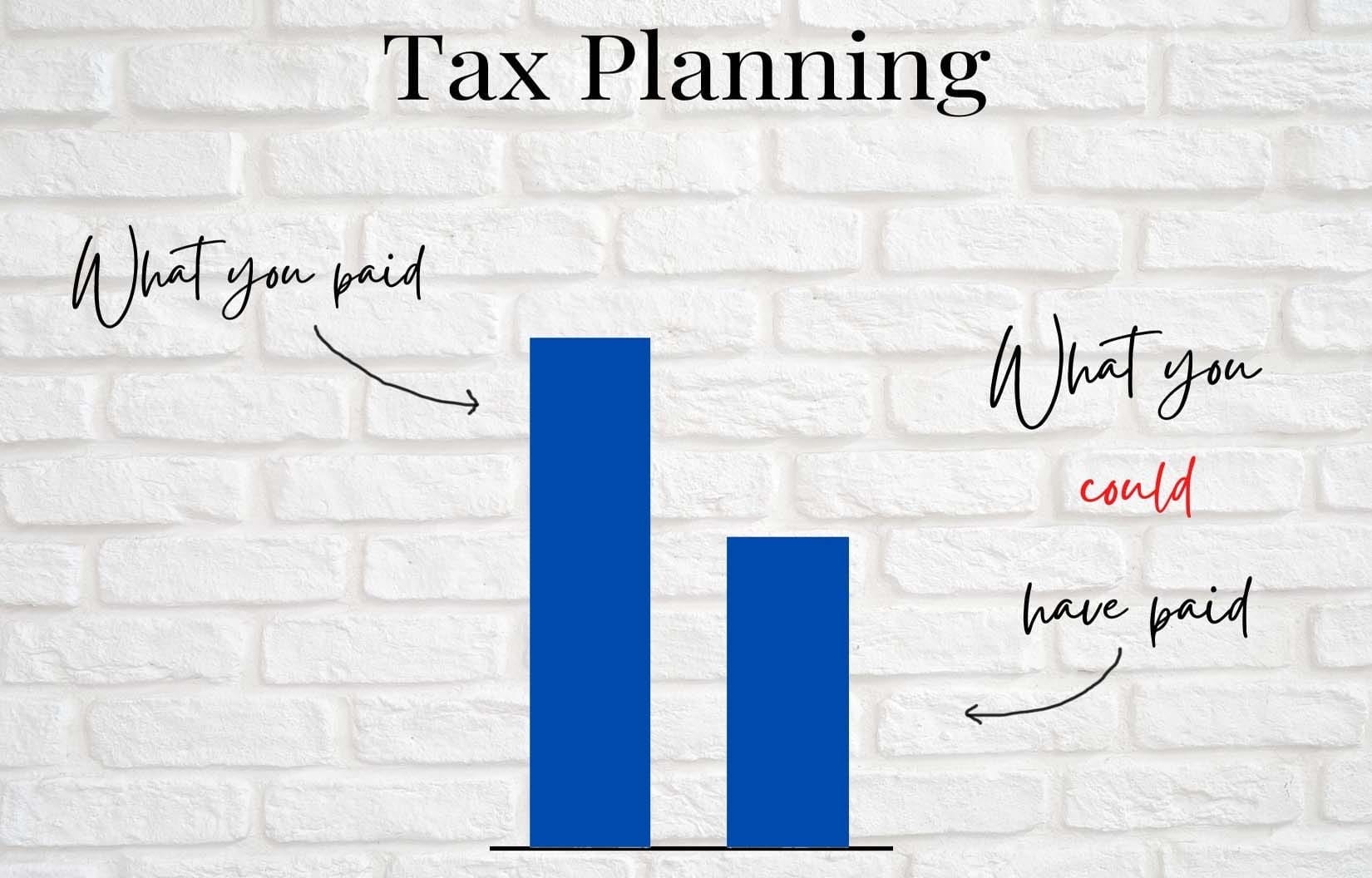

Looking for some extra cash in your business? One of our clients was thrilled to receive additional unexpected money from the IRS this month, when

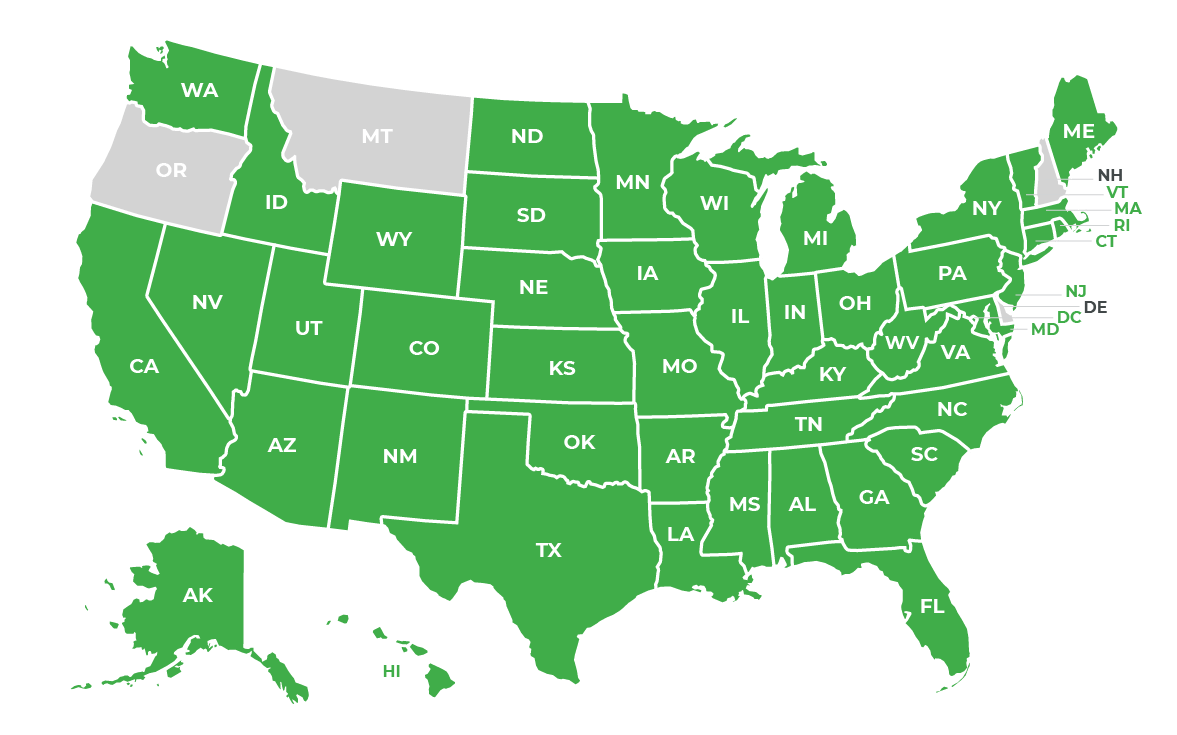

If you’re an e-commerce seller using Shopify to sell your wares, you might have noticed the new Shopify feature alerting sellers of potential new sales

What Businesses and Individuals Need to Know About PPP loans, Tax Credits, and More On December 27, 2020, facing an imminent government shutdown, President Trump

Election season is upon us, and with the economic volatility of 2020 still unsettled, many Americans are primarily interested in the tax impact of each

It seems safe to say none of us really expected 2020 to turn out the way it did. Regardless of whether the year was good

The PPP loan application period has been extended. Small businesses impacted by the pandemic can apply for a forgivable loan until August 8, 2020. SBA

As business owners who received PPP loan funds waited with baited breath, further guidance regarding PPP loans and loan forgiveness was issued this week. The

Get in touch and learn exactly how we can help simplify your finances.